Profectus Capital provides secured loans for income generating purposes to SMEs in Manufacturing and Service Sectors operating in eleven identified Industry-Clusters.

The main loan products are:

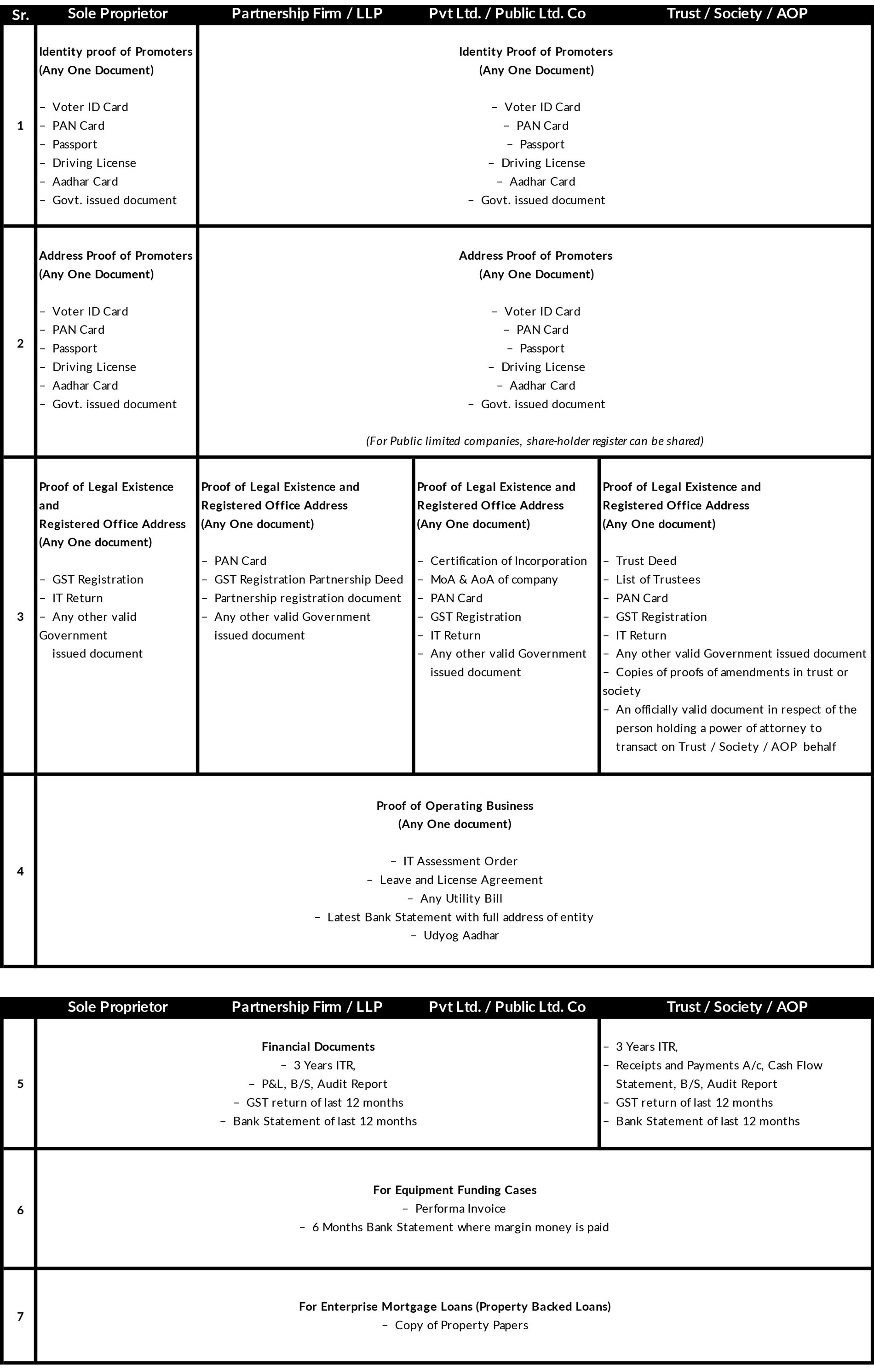

- Enterprise Mortgage Loan: Property Backed Business Expansion Loans

- Machinery and Equipment Funding

- School Funding Program: K12 Schools for upgrading facilities

- Supply Chain Solutions: Anchor backed Dealer Financing, Bill

- Discounting and Vendor Financing

- Merchant Cash Advances: POS based daily repayment type Business Loans

Credit assessment is cash-flow based thus addressing precise funding requirements of SMEs in identified clusters.